Lower rates sound like relief. But this isn’t the comeback of cheap money—it’s the start of a new kind of market; one built on timing, not luck.

If you’re looking to purchase a home right now, you’ve probably noticed a strange tension in the air.

Mortgage rates are easing, Listings are sitting, Open houses are calmer, everyone’s waiting for the next Bank of Canada announcement, wondering if one more cut will finally make the math work.

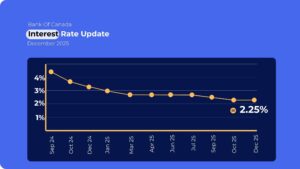

That hesitation is the story of this moment: confidence thawing, not yet flowing. The Bank of Canada’s policy rate sits near 2.25%, significantly down from last year’s restrictive highs. It’s a meaningful shift, but not a full reversal. We’ve entered what economists call a recalibration phase—the space between fear and recovery.

What a Rate Cut Really Does (and Doesn’t) Change

A rate cut is like easing off the brakes on a winding road—it helps, but it doesn’t guarantee speed.

Cheaper borrowing instantly improves affordability on paper, but it also reshapes behaviour. The moment the central bank lowers rates, buyers who have been waiting jump back in, lenders adjust pricing, and competition quietly stirs.

In Ontario, those ripples are already visible. Homes that lingered through the summer are drawing fresh attention. Sellers are negotiating less. In parts of the GTA, multiple offers are reappearing—still cautious, but no longer rare.

That’s the paradox: the same cuts meant to cool anxiety also heat the market back up.

So when you hear that rates have dropped, remember— everyone else has heard it too.

Why ‘Just One More Cut’ Might Cost You More

Every buyer hopes to time it perfectly. The fantasy goes like this: wait one more month, one more announcement, one more quarter-point—and then jump.

But housing rarely moves on your schedule.

Economists estimate it takes 12 to 18 months for monetary policy changes to fully filter through the market. By the time cheaper mortgage options appear in the fine print, the listings you liked are gone and bidding pressure has returned.

We’ve seen this pattern before: the early movers in a cut cycle often secure the most stable prices and the widest choice. Those who wait for certainty end up competing for it.

If you’re looking to purchase a home, the best question isn’t “Will rates drop again?” but “What happens to inventory when they do?” and “Will I still be able to secure the right home for me?

Because once confidence floods back, the quiet you feel now disappears.

Affordability: Progress, But Not a Promise

Affordability is relative, not absolute. Nationally, prices have flattened but not fallen. In much of Ontario, detached homes remain expensive, construction costs stay high, and new housing completions are near 30-year lows.

Still, 2025 has delivered progress on the policy front. For first-time buyers, several incentives are narrowing the gap between income and opportunity:

- Enhanced First-Time Home Buyer’s Tax Credit

- Land Transfer Tax Rebate on homes under $500,000

- HST relief on new construction projects

Together, these can offset thousands in upfront costs—the equivalent of one or two future rate cuts.

For anyone looking to purchase a home, these programs matter. They prove that progress doesn’t always come from the central bank. Sometimes it comes from knowing which levers to pull before everyone else notices they exist.

See also: Finding Affordable Homes in Ontario: A Smart Buyer’s Guide

How to Move with Intention

Buying in 2025 isn’t about chasing the lowest number. It’s about aligning your finances, your timing, and your confidence. Rates will rise and fall. What matters is whether your plan survives both.

Here’s how the most prepared buyers are approaching this market:

- Stress-test your scenario.

Run your affordability at today’s rate + 2 points. If it still fits, you’re shielded from most surprises. - Know your micro-market.

Toronto’s core doesn’t behave like Durham’s suburbs. Detached homes in Mississauga move differently than pre-construction condos downtown. Track the neighbourhoods that fit your budget now—not the ones that made headlines last year. - Think five years, not five months ahead.

A mortgage cycle outlasts most market moods. If your horizon is long enough, a quarter-point either way is noise. - Focus on stability, not perfection.

The right home is the one you can live—and sleep—inside comfortably, regardless of what the next rate announcement brings.

The Sweet Spot Between Fear and FOMO

Every real-estate cycle has two emotional poles. When rates rise, fear freezes buyers. When they fall, fear of missing out floods back in.

In between those extremes is the quiet zone—the rare period where competition softens and rational deals happen.

That’s the moment we’re living in now. Confidence hasn’t caught up to policy yet. Sellers are realistic. Appraisals are steady. Pre-approvals last long enough to act without panic.

For buyers looking to purchase a home, this is the window to negotiate without noise.

It won’t last. Once headlines shift from “Cautious optimism” to “Market rebounds,” the stillness turns into a stampede.

Learn more: Exploring the Best Neighborhoods in Toronto in 2025

A Market Defined by Quiet Momentum

If you zoom out, Canada’s housing story has never been one of sudden crashes or instant recoveries. It’s defined by gradual shifts—confidence of building in whispers before showing up in numbers.

We’re now in one of those quiet chapters. Buyers are circling. Sellers are testing new price points. Builders are still cautious but less fearful. The market isn’t shouting yet, but it’s humming—the early sound of motion returning. In moments like this, readiness matters more than prediction.

Our Take

Housing markets reward preparation, not hesitation.

The buyers who benefit most from lower rates are the ones already pre-approved, informed, and clear on what they can afford.

If you’re looking to purchase a home, use this pause to your advantage. Run your numbers. Watch your neighbourhood. Build your plan before the next announcement moves everyone else.

Because the truth is simple: markets rarely reward those who wait for perfect timing. They reward those who are ready when the timing turns.

At Cityscape, we’ve learned that opportunity rarely announces itself — it appears in the quiet between rate cuts and headlines. That’s where clarity matters most. We offer data-driven insight, local expertise, and homes that fit both your budget and your timing. Connect with us here