Canada’s 2025 Federal Budget places housing at the center of its economic strategy once again. After several years of affordability strain, stalled projects, and uneven regional demand, the government’s new plan focuses on expanding supply, moderating population growth, and introducing programs to accelerate construction.

The numbers suggest the housing market has stabilized from last year’s slowdown but remains far from balanced. Inventory shortages, high construction costs, and weak confidence continue to shape activity or the lack of thereof across much of the country.

This budget signals continuity more than transformation—a long-term effort to build, not a short-term fix.

Market Conditions: Stable but Uneven

National housing activity has regained some footing after a slow start to the year.

Home resales have increased over the past six months, with the exception of the month of Sep, while prices in most cities have flattened. Market data indicate more balanced conditions between buyers and sellers, though regional variations remain wide.

The Bank of Canada’s affordability index has improved for seven consecutive quarters, supported by a 2.75-percentage-point rate reduction since May 2024 and modest income growth. However, affordability remains stretched—especially in large urban centers.

The budget confirms one headline change: the removal of GST for first-time buyers on homes up to $1 million. Combined with recent mortgage rule adjustments, this measure is designed to ease entry into ownership, though it may have limited impact in high-priced regions like Toronto and Vancouver.

Construction Trends and Rental Supply

The most visible progress lies in construction data. Housing starts are averaging around 277,000 units per year — the highest pace since 2021. The increase is driven primarily by purpose-built rental development, which has remained resilient thanks to government-backed programs such as the Apartment Construction Loan Program and Mortgage Loan Insurance for multi-residential projects. These loans are offered through CMHC.

Although builders continue to face elevated financing and labour costs, policy support has helped prevent a sharper decline in housing starts.

Early effects are visible in the rental market, where average asking rents have fallen 3.2 percent year over year—the first national decline in several years.

That easing suggests a modest improvement in availability, though rents in core markets remain well above pre-pandemic levels.

Aligning Population Growth with Housing Capacity

Another structural adjustment comes through population planning.

Under the new Immigration Levels Plan (2026–2028), the number of permanent residents will remain below 1% of the national population, and temporary residents will decline from 7.6% in 2024 to below 5% by 2027.

This shift aims to align housing demand with construction output rather than constrain immigration outright.

For housing markets, the change could help temper rental demand growth while allowing new supply—particularly in multi-unit construction—to catch up.

Build Canada Homes: Scaling the Industry

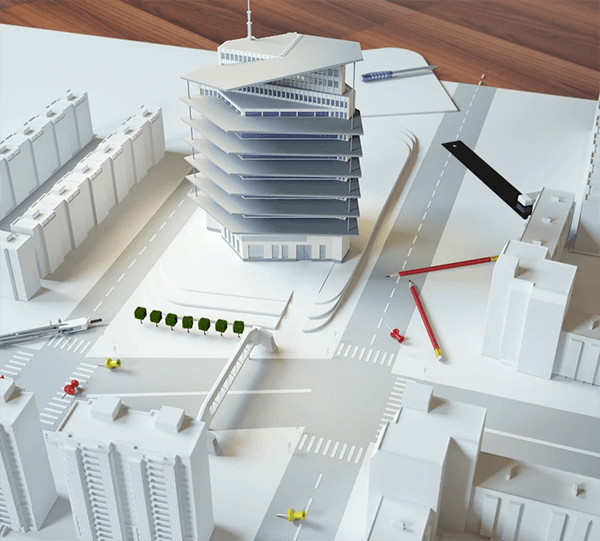

The centerpiece of the housing strategy is Build Canada Homes, a new federal agency tasked with doubling the pace of homebuilding over the next decade.

The agency’s focus areas include:

- Speed and Efficiency: Promoting modular, prefabricated, and mass-timber housing to shorten construction timelines by up to 50% and to reduce costs by approximately 20%.

- Sustainability: Standardizing low-emission construction methods and setting targets to reduce building-related emissions by roughly 20%.

- Coordination: Partnering with provinces, municipalities, and private developers to align financing, procurement, and workforce planning.

For the housing sector, the agency’s success will depend less on innovation and more on implementation—whether it can overcome municipal bottlenecks, supply-chain costs, and regulatory lag.

Tying Infrastructure to Housing Delivery

Federal infrastructure investments will now be linked directly to housing commitments.

Cities receiving funds for transit, utilities, or roads must also zone for additional housing density—at least 25,000 new homes within walking distance of major projects such as subways or LRT lines.

The policy extends the approach used under the Build Faster Fund, rewarding municipalities that speed up approvals and streamline zoning processes.

If effectively coordinated, this could accelerate mid-rise and mixed-use development in transit-accessible areas, though outcomes depend heavily on local execution and political cooperation.

What the Data Show

Recent housing indicators point to moderate but measurable change:

- Resales are recovering modestly.

- Rents have softened slightly.

- Affordability is improving, though unevenly.

Still, the market remains supply constrained. Analysts estimate Canada needs an additional 3.5 million homes by 2030 to restore affordability—far beyond current production capacity.

The 2025 Budget introduces mechanisms to close that gap, but results will take years to materialize. The immediate impact may be psychological rather than structural restoring some predictability after a period of volatility.

Real Estate Perspective

For real estate professionals, the budget provides direction rather than disruption.

- Buyers may find short-term relief in borrowing costs and entry-level incentives, but they continue to face challenges related to the economy and tariffs, which contribute to a sense of insecurity about entering the market.

- Developers gain policy support but still contend with costs and regulatory blocks.

- Investors should watch rental yields closely as new supply reaches the market, and immigration levels adjust.

The market’s trajectory now depends less on sentiment and more on execution—how quickly promised supply translates into completed units.

Canada’s housing policy has entered a long build phase. The 2025 Budget won’t solve affordability, but it confirms that construction—not speculation—will define the next chapter of the market.

You might also be interested in: